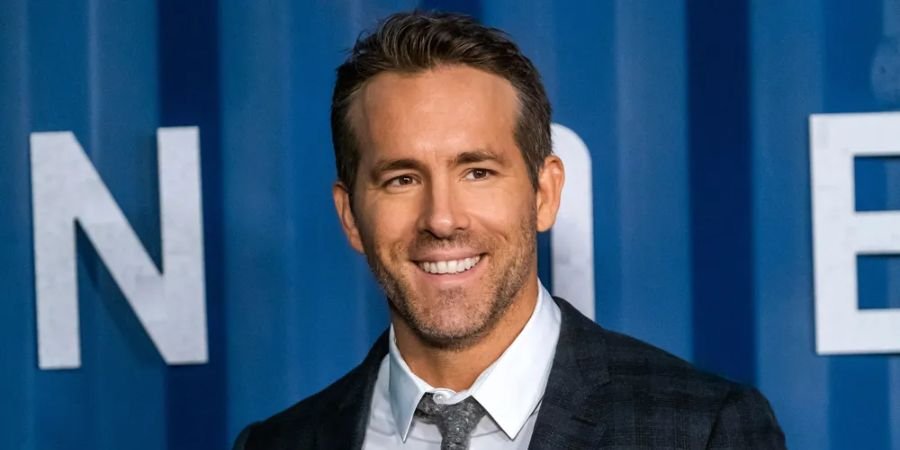

Tesla shares surged nearly 15% in premarket trading on Wednesday following projections by NBC News that former President Donald Trump would win the election, boosting investor optimism about the potential benefits for Tesla and its CEO, Elon Musk. The surge in Tesla’s stock comes amid increasing confidence in Musk’s close ties to Trump and the possibility of him playing a pivotal role in the next administration.

Tesla Soars as Trump’s Victory Could Boost Musk’s Power

The early Wednesday stock jump follows NBC’s projection that Trump would defeat Democrat Kamala Harris, after losing his reelection bid to President Joe Biden in 2020. While the official results have not yet been confirmed, the market responded enthusiastically to the idea of a Trump presidency, with Tesla shares climbing sharply as investors bet on Musk’s strengthened influence.

Musk, a major backer of the Republican Party, has already shown his financial support, donating nearly $75 million to America PAC, a super PAC he founded to back Republican candidates, including Trump. The Tesla CEO’s endorsement and financial contributions have made him a key player in Trump’s political network, and the possibility of Musk receiving a prominent government position has further fueled speculation about the future of Tesla’s stock.

Musk’s Role in a Potential Trump Administration

In his October rally at Madison Square Garden, Trump promised to appoint Musk as the head of a new government efficiency commission, should he win the election. Musk has previously spoken about his desire to reduce government waste, and in this role, he has suggested he could cut as much as $2 trillion from the federal budget.

“If we get the government off your back and out of your pocketbook, we’re going to fix that,” Musk said at the rally. His potential influence in a Trump administration is viewed as a major factor driving Tesla’s stock price higher, even as other sectors brace for potential challenges under a Trump presidency.

A Mixed Outlook for Tesla and the EV Industry

Despite Tesla’s significant price jump, the overall outlook for electric vehicle (EV) manufacturers under a Trump presidency remains mixed. Trump has been viewed as somewhat unfavorable to the clean energy sector, with concerns that government subsidies, tax rebates, and incentives for EVs could be rolled back under his administration.

Dan Ives, managing director at Wedbush Securities, acknowledged this, noting that a Trump presidency could signal a challenging environment for the EV industry as a whole, with potential cuts to incentives for electric vehicles. However, Ives sees Tesla’s large scale and industry dominance as a unique advantage in a more subsidy-reduced market.

A Critical Time for Tesla’s Future

As of Tuesday’s market close, Tesla shares have underperformed the broader market in 2024, with a modest 1.2% increase year-to-date, compared to a 21.2% rise in the S&P 500. However, the 3.5% gain on Tuesday marked a positive turnaround, breaking a six-day losing streak.

Despite some skepticism about Trump’s stance on clean energy, the potential for Musk to wield greater political influence under a Trump presidency has investors betting that Tesla’s future remains strong. The shifting political winds and Musk’s prominent role in shaping policy could prove crucial for Tesla’s continued dominance in the electric vehicle market.

As the election results continue to unfold, all eyes will be on how the political landscape influences Tesla’s growth and its standing in the broader automotive and technology sectors.

Read Also: Perplexity CEO Aravind Srinivas Offers Strike Support to NYT, Sparking Controversy