Nvidia’s stock has experienced a remarkable 25% increase over the past month, positioning it near a record high just as the tech earnings season approaches. Major players in the technology sector, including Meta, Microsoft, and Alphabet, are set to disclose their anticipated investments in artificial intelligence (AI) in the coming weeks, fueling investor enthusiasm around Nvidia’s prospects.

Following a brief downturn in late August and early September, Nvidia has seen a sharp recovery. The stock closed at $132.65 on Wednesday, just shy of its June peak of $135.58. This impressive performance has allowed Nvidia to surpass Microsoft as the second-most valuable company, trailing only Apple.

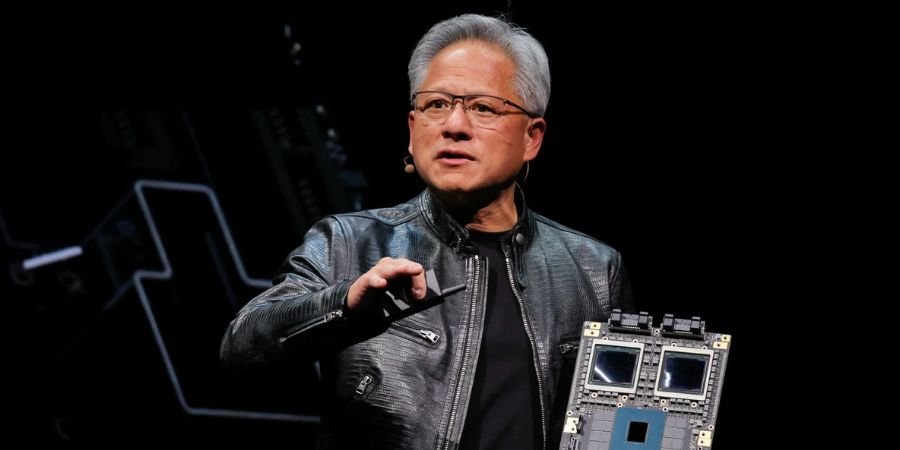

Nvidia: The AI Leader

Nvidia has emerged as a primary beneficiary of the AI boom, with tech giants like Meta, OpenAI, and Oracle increasingly reliant on the company’s powerful graphics processing units (GPUs) to develop cutting-edge technologies. The company reported exceptional fiscal second-quarter earnings in August, revealing a staggering 122% year-over-year revenue increase, alongside a net income of $16.6 billion—more than double from the previous year.

Furthermore, Nvidia provided a strong outlook for the current quarter, indicating that it expects to ship several billion dollars’ worth of its new Blackwell AI chips. The demand for its current-generation Hopper chips is also projected to rise over the next two quarters, highlighting the company’s strong position in the market.

Analysts Weigh In

Mizuho analysts reaffirmed Nvidia’s dominance in the AI chip market, estimating that the company holds approximately 95% market share in data center applications. They set a price target of $140 for Nvidia shares, while also acknowledging potential risks. These risks include escalating export restrictions to China, geopolitical tensions involving Taiwan, and a possible downturn in AI server spending.

Stock Movements and Investor Sentiment

The recent stock rally can also be attributed to various factors, including market sentiment following Huang’s completion of stock sales, which triggered a 4% increase on September 23. Investor interest in Nvidia remains robust, with analysts and market watchers keeping a close eye on its performance as the tech sector prepares for a busy earnings period.

As Nvidia continues to lead in the AI hardware space, its upcoming announcements and market movements will be pivotal in shaping the outlook for both the company and the broader tech industry.

Read Also: City Therapeutics Launches with $135 Million Investment Led by John Maraganore